In 2026, the conversation around solar energy in India has shifted from “Is it expensive?” to “How much can I save?”. With electricity tariffs in states like Maharashtra, Karnataka, and Rajasthan rising by 5-10% annually, homeowners are looking for a permanent exit from high monthly bills. The solution lies in the Government solar panel scheme—specifically the PM Surya Ghar: Muft Bijli Yojana. This flagship initiative aims to provide free electricity to over 1 crore households. But navigating the math can be confusing. How much is the actual subsidy? What is the final cost out of your pocket? And is the “Zero Electricity Bill” a reality?

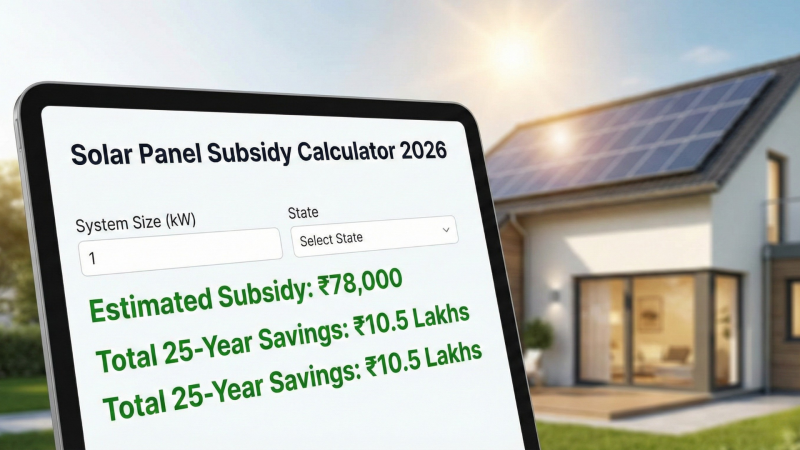

This guide breaks down the numbers with a 2026 Solar Panel Subsidy Calculator, helping you decide exactly which system fits your roof and budget.

What is the Government Solar Panel Scheme (PM Surya Ghar)?

The Government solar panel scheme, officially known as the PM Surya Ghar Muft Bijli Yojana, is a central government initiative designed to subsidize the installation of rooftop solar systems for residential homes.

Unlike previous schemes where the subsidy release was slow, the 2026 framework operates on a DBT (Direct Benefit Transfer) model. This means the subsidy amount is credited directly to your bank account within 30 days of commissioning the system.

Key Highlights for 2026:

- Target: Free electricity for households consuming up to 300 units/month.

- Subsidy Cap: The maximum subsidy is capped at ₹78,000 for systems of 3kW and above.

- Process: Fully digital application via the National Portal for Rooftop Solar (pmsuryaghar.gov.in).

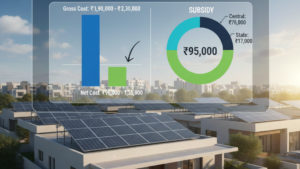

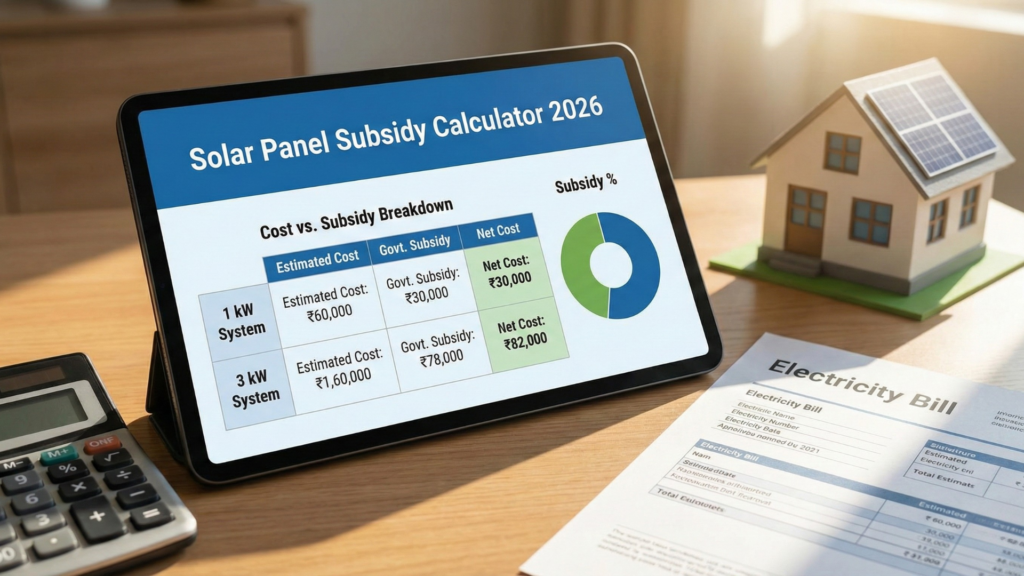

Solar Panel Subsidy Calculator 2026 (Cost vs. Subsidy Breakdown)

Many homeowners search for a “Government solar panel scheme” calculator to understand their upfront costs. Below is a detailed breakdown of the estimated market price versus the government subsidy for the most common residential system sizes in India.

Note: Market prices are estimates for “On-Grid” systems (without batteries) and can vary by 5-10% depending on the brand (e.g., Waaree, Tata Power, Adani) and your state.

Table 1: Subsidy & Net Cost Breakdown (Residential)

| System Capacity | Avg. Market Cost (Before Subsidy) | Govt. Subsidy Amount (Central) | Net Cost to Customer (Approx.) | Roof Area Required |

| 1 kW | ₹50,000 – ₹60,000 | ₹30,000 | ₹20,000 – ₹30,000 | ~100 sq. ft. |

| 2 kW | ₹1,00,000 – ₹1,10,000 | ₹60,000 | ₹40,000 – ₹50,000 | ~200 sq. ft. |

| 3 kW | ₹1,50,000 – ₹1,70,000 | ₹78,000 (Max) | ₹72,000 – ₹92,000 | ~300 sq. ft. |

| 4 kW | ₹2,00,000 – ₹2,20,000 | ₹78,000 | ₹1,22,000 – ₹1,42,000 | ~400 sq. ft. |

| 5 kW | ₹2,50,000 – ₹2,80,000 | ₹78,000 | ₹1,72,000 – ₹2,02,000 | ~500 sq. ft. |

| 10 kW | ₹4,50,000 – ₹5,00,000 | ₹78,000 | ₹3,72,000 – ₹4,22,000 | ~1000 sq. ft. |

State Top-Up Subsidy under the Government Solar Panel Scheme

While the table above lists the Central subsidy, many states offer an additional top-up.

- Uttar Pradesh & Rajasthan: Often provide extra state-level subsidies (e.g., ₹15,000–₹30,000 extra), which can further reduce your net cost.

- Delhi: Has historically offered generation-based incentives (GBI).

- Always check your local DISCOM website for the latest state-specific top-ups.

Return on Investment (ROI): How Much Can You Really Save?

Investing in the Government solar panel scheme isn’t just about the upfront discount; it’s about the long-term savings. Solar panels have a lifespan of 25 years. Below is an analysis of how quickly you will recover your investment (Payback Period) and your total lifetime savings.

Table 2: Payback Period with Government Solar Panel Scheme

| System Size | Daily Units Generated (Avg) | Monthly Bill Savings (Approx) | Annual Savings | Payback Period | Total Savings (25 Years) |

| 1 kW | 4-5 Units | ₹1,000 – ₹1,200 | ₹12,000 – ₹14,000 | ~1.5 – 2 Years | ₹3.5 Lakh+ |

| 2 kW | 8-10 Units | ₹2,000 – ₹2,400 | ₹24,000 – ₹28,000 | ~2 Years | ₹7 Lakh+ |

| 3 kW | 12-15 Units | ₹3,000 – ₹3,600 | ₹36,000 – ₹43,000 | ~2.5 Years | ₹10 Lakh+ |

| 5 kW | 20-25 Units | ₹5,000 – ₹6,000 | ₹60,000 – ₹72,000 | ~3 – 4 Years | ₹18 Lakh+ |

Assumptions: Average electricity rate of ₹8/unit. Solar generation varies by state (higher in Rajasthan/Gujarat, lower in hilly regions).

The Hidden Benefit of Net Metering

Your savings rely heavily on Net Metering. This is a billing mechanism where you export excess electricity generated during the day back to the grid.

- Daytime: Your solar panels run your home appliances. Excess power goes to the grid.

- Nighttime: You draw power from the grid.

Bill Calculation: You only pay for the net difference (Imported Units – Exported Units). If you export more than you use, your bill is effectively zero (or minimum service charges).

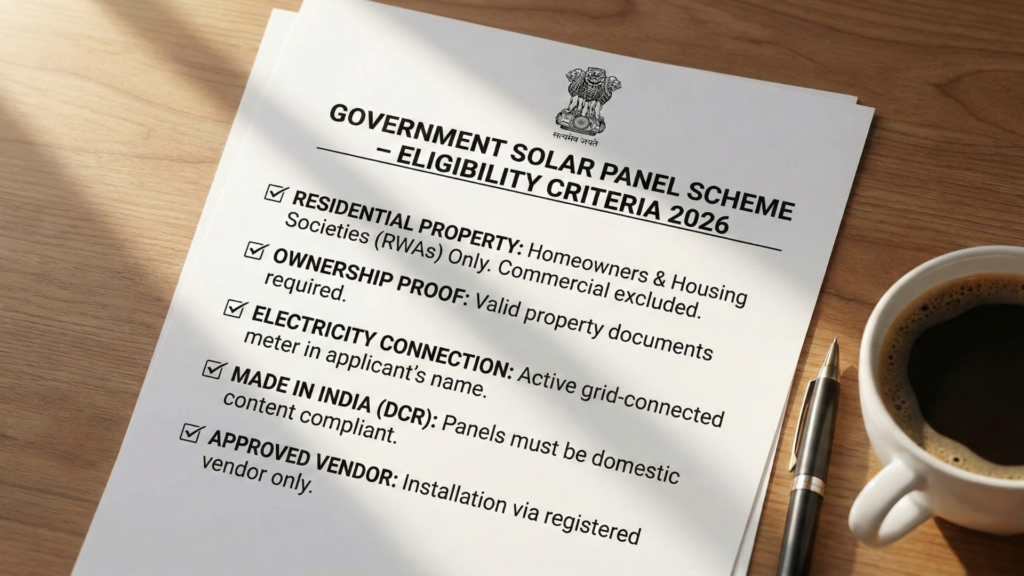

Eligibility Rules for the Government Solar Panel Scheme 2026

Not every home automatically qualifies for the subsidy. To take advantage of the Government solar panel scheme, you must meet these specific requirements:

- Residential Property: The subsidy is available only for residential homes and Housing Societies (RWAs). Commercial offices, factories, and schools generally do not qualify for the PM Surya Ghar subsidy (though they can claim depreciation benefits).

- Ownership: The applicant must own the property, or have valid proof of authorization if the electricity bill is in a relative’s name (e.g., deceased father).

- Electricity Connection: You must have an active grid-connected electricity meter in your name.

- Made in India (DCR): The solar panels installed must be Domestic Content Requirement (DCR) compliant. This means the solar cells and modules must be manufactured in India (e.g., Adani, Waaree, Vikram Solar, Premier Energies). Imported panels do not get a subsidy.

- Approved Vendor: You must install the system through a vendor registered on the National Portal. Installing it yourself or using a local un-registered electrician will disqualify you from the subsidy.

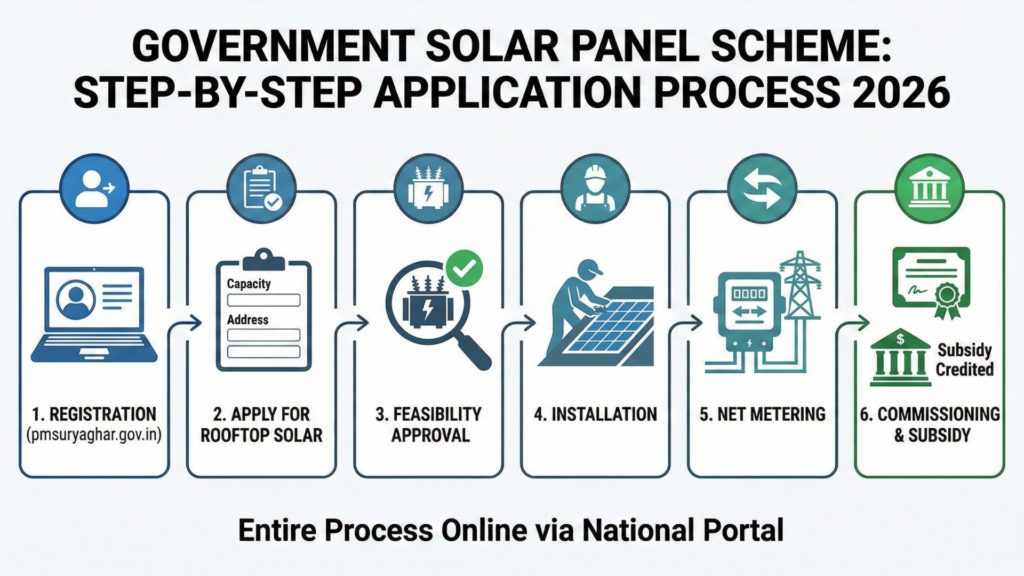

How to Apply for the Government Solar Panel Scheme (Step-by-Step)

Applying for the Government solar panel scheme is strictly online. Follow these steps to ensure your application is not rejected:

Step 1: Registration

Visit the official portal pmsuryaghar.gov.in. Register using your Mobile Number and Electricity Consumer Number. You will need to select your State and DISCOM (Distribution Company).

Step 2: Apply for Rooftop Solar

Once logged in, fill out the application form. You will need to provide details like your address, the capacity you wish to install (e.g., 3kW), and your bank account details for the subsidy transfer.

Step 3: Feasibility Approval

Your local DISCOM will review your application to check if the local transformer can handle the load. This usually takes 3-7 days. Once you get the “Technical Feasibility Approval,” you can proceed.

Step 4: Installation

Select a registered vendor from the portal’s list. Sign an agreement with them. They will install the DCR-compliant solar panels and the inverter.

Step 5: Net Metering

After installation, apply for a Net Meter. DISCOM officials will visit your home to install the bi-directional meter and inspect the system (checking for earthing, lightning arresters, etc.).

Step 6: Commissioning & Subsidy

Once the Net Meter is installed, a “Commissioning Certificate” is generated online. You must upload a photo of the installed system and a cancelled cheque. The subsidy will be credited to your bank account within 30 days.

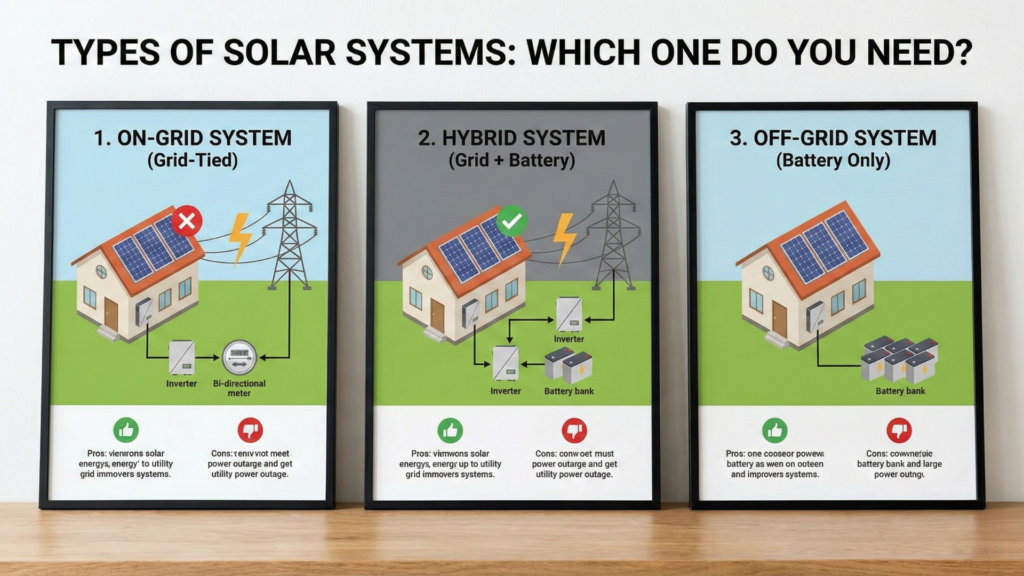

Approved Systems for the Government Solar Panel Scheme

When applying for the Government solar panel scheme, you will encounter three main types of technologies. It is crucial to choose the right one for your needs.

1. On-Grid Solar System (Most Popular)

- How it works: Connected to the government grid.

- Pros: Cheapest option; qualifies for full subsidy; Net Metering allows for zero bills.

- Cons: Does not work during a power cut. (This is a safety feature called anti-islanding).

- Best for: Cities with rare power cuts (e.g., Delhi, Mumbai, Jaipur, Bangalore).

2. Hybrid Solar System

- How it works: Connected to the grid and has a battery backup.

- Pros: Works during power cuts; reduces bills.

- Cons: significantly more expensive due to batteries. The subsidy is calculated only on the solar panel capacity, not on the batteries.

- Best for: Areas with frequent power cuts (Tier-2/3 cities).

3. Off-Grid Solar System

- How it works: Completely disconnected from the grid. Battery dependent.

- Pros: Total independence.

- Cons: No subsidy is usually available for purely off-grid residential systems under the main scheme; expensive maintenance.

- Best for: Remote farmhouses where grid electricity hasn’t reached.

Conclusion: Should You Opt for the Government Solar Panel Scheme?

Absolutely. The combination of falling solar panel prices and the aggressive Government solar panel scheme makes 2026 the “Golden Year” for solar adoption in India.

By installing a 3kW system, you are essentially pre-paying for your electricity at a rate of approx. ₹2 per unit (over 25 years), while your neighbors pay ₹8 to ₹12 per unit. With an ROI of less than 3 years and a warranty of 25 years, solar is one of the safest financial investments an Indian household can make today.

Action Plan:

- Check your average monthly units on your electricity bill.

- If you use 300+ units, aim for a 3kW system to maximize the ₹78,000 subsidy.

- Register on the PM Surya Ghar portal today to lock in current rates.

Frequently Asked Questions (FAQ)

Q1: Is the government solar panel scheme totally free?

No. The scheme is “free” in the sense that it aims to eliminate your electricity bill (Muft Bijli). However, you have to pay for the installation upfront. The government refunds a significant portion (up to ₹78,000) as a subsidy, and the rest is recovered through electricity savings in about 3 years.

Q2: Can I get a loan for solar installation?

Yes. Under the PM Surya Ghar Yojana, all major banks (SBI, Canara, PNB, etc.) offer solar loans at low interest rates (currently around 7% – 9%). You can apply for this loan directly through the Jan Samarth portal linked to the solar scheme.

Q3: What happens to the solar panels if I shift my house?

Solar systems are movable assets. You can pay a vendor to dismantle the structure and panels and reinstall them at your new location. However, you will need to apply for Net Metering again at the new address.

Q4: Do I get a subsidy for a 5kW or 10kW system?

Yes, you get a subsidy, but it is capped. Whether you install 3kW, 5kW, or 10kW, the maximum central subsidy you will receive is fixed at ₹78,000. The remaining cost must be borne by you.

Q5: How do I know if my vendor is charging the right price?

Always compare quotes from at least 3 vendors. Check the “Benchmark Costs” released by MNRE for 2026. If a vendor quotes significantly higher than ₹60,000/kW for a standard system, ask for a detailed component breakdown.