Switching to solar energy is one of the smartest financial decisions an Indian homeowner can make in 2025. With electricity tariffs in states like Rajasthan and Maharashtra touching ₹8 to ₹12 per unit, the “free electricity” promise of solar is very real. However, the initial price tag—often ranging from ₹1.5 Lakh to ₹4 Lakh—can be a barrier for many middle-class families. This is where understanding your solar panel financing options becomes critical.

Gone are the days when you needed full cash upfront. Today, thanks to the PM Surya Ghar Muft Bijli Yojana and competitive bank loans, going solar is more affordable than buying a new motorcycle. Whether you want to own the system to claim the government subsidy or simply want to reduce your bill without spending a rupee, there is a financing structure for you.

In this guide, we will break down the primary financing models in India: Solar Loans (CAPEX), RESCO (OPEX), and Government Subsidies. We will compare them side-by-side to help you decide which path leads to the best ROI (Return on Investment).

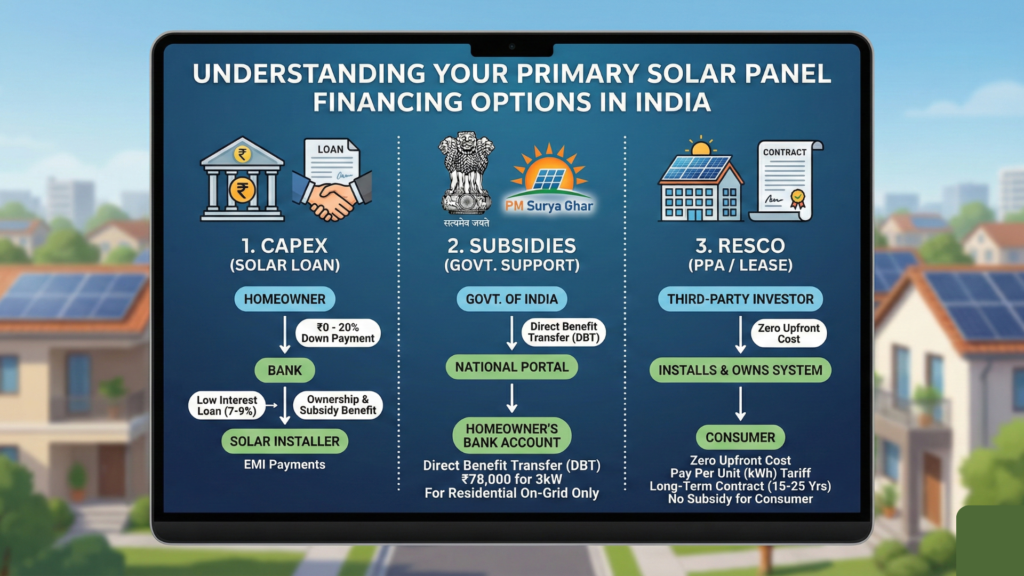

Understanding Your Primary Solar Panel Financing Options in India

In India, the market works slightly differently than in the US or Europe. The two main models are CAPEX (Capital Expenditure – where you buy it) and OPEX/RESCO (Operating Expenditure – where you just buy the power).

1. Solar Loans (CAPEX Model): The Path to Ownership

This is the most popular choice for residential homeowners in India (90% of the market). You take a loan to buy the system, you own it, and you get the subsidy.

How Solar Loans Work in 2025:

Banks like SBI, HDFC, and ICICI have specific “Green Loan” products. Under the PM Surya Ghar scheme, public sector banks offer collateral-free loans for systems up to 3kW at very low interest rates.

- Secured Loans (Home Loan Top-up): If you already have a home loan, you can ask your bank for a “Top-up loan” for solar. These offer the cheapest rates (approx 8.5% – 9.5%).

- Solar Specific Loans: Banks offer dedicated solar loans. For example, SBI’s Surya Ghar Loan currently offers rates around 7% for eligible applicants under the scheme.

- NBFC Loans: If you don’t have a strong credit history for a bank loan, NBFCs (like Ecofy or Metafin) offer faster approvals but at higher rates (11% – 14%).

Pros of Solar Loans:

- You Get the Subsidy: As the owner, you directly receive the ₹78,000 subsidy (for 3kW) into your bank account.

- Asset Creation: The solar system adds value to your property.

- Free Electricity Later: Once the loan is paid off (usually in 3-5 years), you get free electricity for the remaining 20+ years of the panel’s life.

Cons of Solar Loans:

- Maintenance: You are responsible for cleaning the panels (though it’s as simple as washing a car).

- Credit Score: You need a CIBIL score of 700+ for the best bank rates.

2. RESCO Model (OPEX): The “Zero Investment” Option

RESCO stands for Renewable Energy Service Company. This is similar to a “Solar Lease” or PPA in western countries.

How RESCO Works:

A solar company installs the panels on your roof at zero cost to you. They own the system and maintain it. You sign an agreement to buy the electricity generated by these panels at a rate cheaper than your DISCOM (electricity board).

- Example: If JVVNL (Jaipur) charges you ₹8/unit, the RESCO developer might sell you solar power at ₹5/unit.

Pros of RESCO:

- ₹0 Down Payment: You pay nothing upfront.

- No Risk: If the inverter breaks or panels get damaged, the company fixes it at their cost.

- Immediate Savings: Your electricity bill drops from Day 1.

Cons of RESCO:

- No Subsidy for You: The developer claims the government benefits, not you.

- Rare for Individual Homes: Most RESCO companies prefer large rooftops (Schools, Hospitals, Factories) or large Housing Societies. It is harder to find for a small 2BHK or 3BHK individual house.

- Long Contracts: You are locked into a 15-25 year contract.

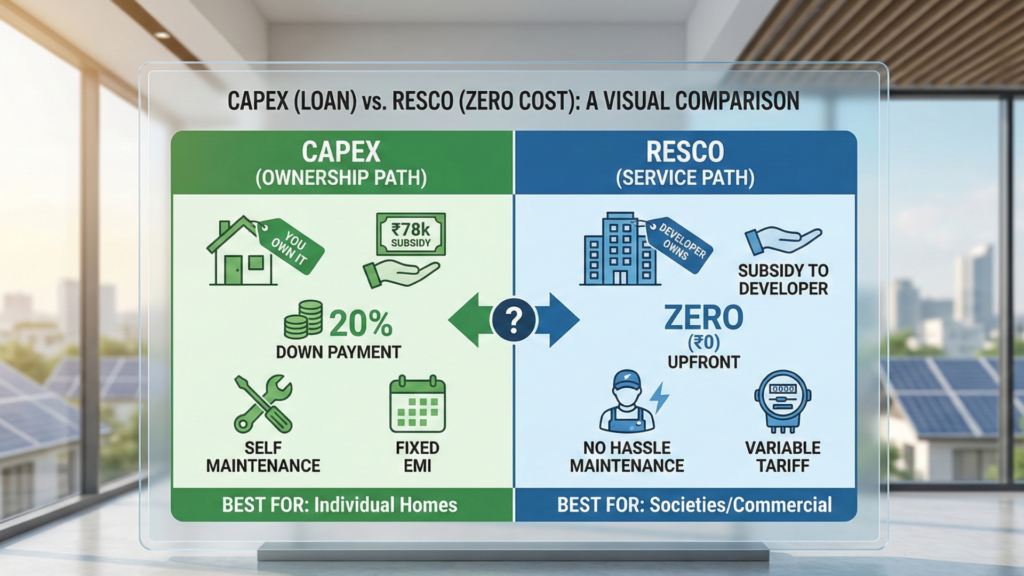

Comparison Table: CAPEX (Loan) vs. RESCO (Zero Cost)

To help you visualize the differences, here is a detailed comparison of the top solar panel financing options in India.

| Feature | CAPEX (Solar Loan) | RESCO (OPEX / Lease) |

| Who Owns the System? | You (Homeowner) | Solar Company (Developer) |

| Upfront Cost | 20% Margin Money (Rest is Loan) | Zero (₹0) |

| Govt. Subsidy (₹78k) | You keep it | Developer keeps it |

| Maintenance | Your Responsibility | Developer’s Responsibility |

| Monthly Payment | Loan EMI (Fixed) | Tariff per Unit (Variable) |

| ROI (Return on Inv.) | High (25-30%) | Medium (Savings only) |

| Best For | Independent Houses, Villas | Large Societies, Commercial |

Financial Breakdown: Is a Loan Better than Paying the Bill?

Many people in Jaipur ask, “Why take a loan and pay interest?” The answer is simple: The EMI is often less than your current electricity bill.

Here is a calculation for a standard 3kW System (ideal for a family with AC, Fridge, and TV).

Cost Analysis Table (3kW System in India)

| Cost Component | Amount (Estimates) |

| Total System Cost | ₹1,80,000 |

| Govt. Subsidy (PM Surya Ghar) | (-) ₹78,000 |

| Net Cost to You | ₹1,02,000 |

| Loan Option (5 Years) | |

| Loan Amount | ₹1,00,000 |

| Monthly EMI (@ 9% Interest) | ₹2,075 |

| Your Old Electricity Bill | ₹3,000 – ₹3,500 |

| Monthly Savings | ₹1,000+ (Immediately!) |

Result: You are saving money from the very first month. Instead of paying ₹3,000 to the electricity board forever, you pay ₹2,075 to the bank for 5 years, and then ₹0 for the next 20 years.

Critical Eligibility Factors for Solar Panel Financing Options in India

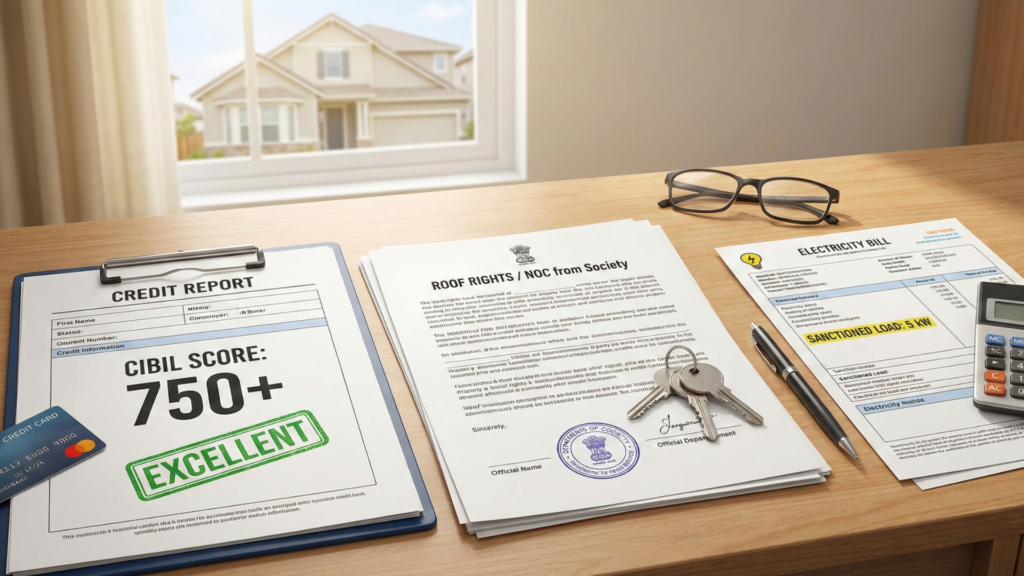

1. CIBIL Score Requirements for Solar Financing

For the PM Surya Ghar loan schemes (especially from SBI or Canara Bank), a CIBIL score of 700 or above is preferred. If your score is lower, you may have to approach an NBFC, where interest rates might be 12-14% instead of 7-9%.

2. Roof Rights and Documentation needed for Financing

To get a loan or subsidy, the electricity bill and the roof property papers must usually be in the same name. If you live in a flat/apartment, you need “Roof Rights” or permission from your society (NOC) to install panels.

3. Sanctioned Electricity Load Impact on Financing

Your solar system capacity usually cannot exceed your home’s sanctioned load (the kW limit on your electricity bill). If you want a bigger solar system, you must first apply to your DISCOM to increase your sanctioned load.

Conclusion: Choosing the Best Solar Panel Financing Option for Your Home

The landscape of solar panel financing options in India has changed drastically in 2025. With the PM Surya Ghar Yojana offering a flat ₹78,000 subsidy for 3kW systems, the CAPEX (Loan) model is the clear winner for most Indian households. It allows you to own the asset, claim the subsidy, and eliminate your electricity bill permanently after the loan tenure.

While the RESCO model sounds attractive due to “zero investment,” it is generally better suited for factories or large societies rather than individual homeowners.

Your Next Step:

Check your latest electricity bill. If you are paying more than ₹2,500 per month, a solar loan is cheaper than your bill. Visit the PM Surya Ghar portal or your local bank branch to check your eligibility for a collateral-free solar loan today.

Frequently Asked Questions (FAQ) About Solar Panel Financing Options

Q1. How do I get the ₹78,000 subsidy?

A. You must register on the PM Surya Ghar National Portal. Once your system is installed by a registered vendor and the “Net Meter” is installed by your electricity provider, the government transfers the subsidy directly to your bank account within 30 days.

Q2. Can I get a solar loan if I am retired?

A. Yes, pensioners can get solar loans from banks like SBI or PNB, provided they have a steady pension income. Alternatively, the loan can be taken in the name of an earning family member (son/daughter) who resides in the same house.

Q3. What is the interest rate for a Solar Loan in 2025?

A. Under the PM Surya Ghar scheme, interest rates for systems up to 3kW are currently very low, around 7% to 9% p.a. For larger systems (above 3kW) or commercial loans, rates range from 9% to 12%.

Q4. Does the bank mortgage my house for a solar loan?

A. For small loans (up to ₹2 Lakhs for a 3kW system), most public sector banks offer collateral-free loans, meaning they do not mortgage your house. The solar panels themselves are considered the primary security (hypothecation).

Q5. What is the difference between On-Grid and Off-Grid financing?

A. Banks and the Government heavily prefer On-Grid systems (connected to the city supply). Subsidies are ONLY available for On-Grid systems. Financing an Off-Grid system (with batteries) is harder and more expensive because there is no subsidy support for the batteries.