In the modern competitive landscape, small and medium enterprises (SMEs) are constantly looking for ways to trim operational fat and boost profit margins. One of the most significant overheads for any physical business—be it a retail store, a small factory, or a corporate office—is electricity. As utility rates continue to climb globally, a solar panel installation for small business has transitioned from a “green luxury” to a strategic financial necessity.

Many business owners hesitate because they believe the “payback period”—the time it takes for the system to pay for itself through savings—is 10 to 15 years. However, with the right combination of technology, tax incentives, and financial planning, you can achieve a 3-year solar payback period.

The Financial Logic Behind Solar Panel Installation for Small Business

Before diving into the “how-to,” we must understand the “what.” The Return on Investment (ROI) for solar energy isn’t just about lower monthly bills; it is a multifaceted financial recovery system. For a small business, every dollar saved on energy is a dollar added directly to the net profit.

When you invest in a solar panel installation for small business, you are essentially “pre-purchasing” 25 years of electricity at a fixed, heavily discounted rate. To hit the 3-year target, we focus on three pillars: Upfront Cost Reduction, Tax Optimization, and Performance Maximization.

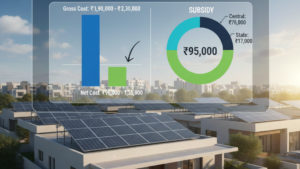

Pillar 1: Leveraging Government Incentives and Tax Breaks

The fastest way to shorten your payback period is to ensure you aren’t paying the full “sticker price” for your system. Government bodies worldwide are incentivizing the transition to renewable energy.

Leveraging The Federal Investment Tax Credit (ITC) for Solar Panel Installation for Small Business

In many regions, specifically the US and similar economies, the Investment Tax Credit allows businesses to deduct a significant percentage (often 30%) of the total cost of their solar panel installation for small business directly from their federal taxes. This is a dollar-for-dollar credit, not just a deduction.

Accelerated Depreciation (The Secret ROI Booster)

This is where small businesses have a massive advantage over residential homeowners. Under systems like the Modified Accelerated Cost Recovery System (MACRS), businesses can depreciate the value of their solar equipment over a very short period—sometimes even 100% in the first year through “Bonus Depreciation.” This drastically reduces your taxable income, providing a massive cash injection back into the business within the first 12 months.

Pillar 2: Strategic System Design and Technology

To break even in 36 months, your system must perform at peak efficiency. Not all solar panels are created equal. If you buy “budget” panels, they may take 7 years to pay back because their energy yield is low.

Table 1: Comparison of Solar Tech & Impact on Payback

| Feature | Low-Cost Standard Panels | High-Efficiency N-Type/TOPCon |

| Energy Conversion Rate | 15% – 17% | 22% – 24% |

| Degradation Rate | 0.7% Per Year | 0.4% Per Year |

| Performance in Heat | Drops significantly | Remains stable |

| Payback Impact | Extends to 6+ Years | Shortens to 3 Years |

| Space Required | More Roof Space | Less Roof Space |

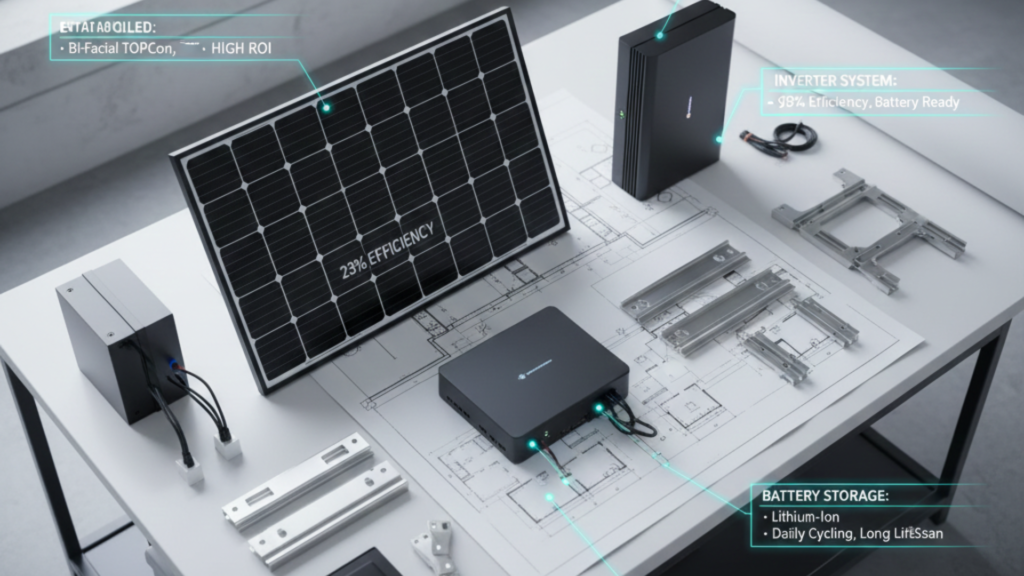

Choosing the Right Inverter

The inverter is the “brain” of your solar panel installation for small business. Using string inverters with power optimizers or micro-inverters ensures that if one panel is covered by a leaf or a shadow, the rest of the system continues to produce at 100%. This prevents “energy leakage” and keeps your savings on track.

Pillar 3: Optimizing Energy Consumption Patterns

A 3-year payback is only possible if you are actually using the power you produce. Selling power back to the grid (Net Metering) is great, but “Self-Consumption” is better.

Aligning Business Hours with Peak Sun

Most small businesses operate from 9 AM to 6 PM. This is the “Golden Window” for solar. By shifting high-energy tasks—such as running heavy machinery, industrial dishwashers, or HVAC cooling cycles—to the middle of the day, you avoid “Peak Pricing” from the utility company.

Smart Monitoring Systems

Modern solar panel installation for small business setups come with AI-driven monitoring. These apps show you exactly when you are wasting power. By identifying “vampire loads” (machines that stay on overnight unnecessarily), you can further reduce your reliance on the grid and accelerate your ROI.

Detailed Component Selection for High ROI

To help you plan, here is a breakdown of the hardware that supports a rapid break-even point.

Table 2: Recommended Hardware for a 3-Year ROI Goal

| Component | Recommendation | Reason for Choice |

| Solar Modules | Bi-facial TOPCon Panels | Generates power from both sides, increasing yield by up to 15%. |

| Inverter System | Hybrid Smart Inverter | Allows for easy battery integration later without replacing hardware. |

| Racking/Mounting | Ballasted Flat-Roof Mounts | No roof penetrations; faster (cheaper) installation labor. |

| Cabling | High-Gauge Copper | Minimizes “voltage drop” or energy loss during transport. |

Step-by-Step Implementation of Solar Panel Installation for Small Business

If you are ready to move forward, follow these steps to ensure your solar panel installation for small business is optimized for financial speed.

Step 1: Conduct a Professional Energy Audit

Before buying panels, reduce your waste. Switching to LED lighting and sealing air leaks in your building can reduce your required system size, lowering the initial investment cost.

Step 2: Compare Three Commercial Quotes

Don’t settle for the first door-to-door salesperson. Look for installers who specialize in commercial (not just residential) work. Commercial installers understand the nuances of business tax codes and heavy-duty electrical panels.

Step 3: Secure “Green Financing”

Many banks offer specialized loans for solar panel installation for small business. If your loan interest is lower than the rate of utility inflation, the system becomes “cash-flow positive” from month one.

Step 4: Claim Every Incentive

Work with a tax professional who understands renewable energy. Ensure you claim the ITC, Accelerated Depreciation, and any local state grants or RECs (Renewable Energy Certificates) available in your area.

Marketing the “Green Advantage” of Your Solar Panel Installation for Small Business

While the 3-year payback is a financial goal, the “Soft ROI” is equally powerful. In 2025, consumers are actively seeking out sustainable businesses.

- B2B Advantage: If you are a supplier to larger corporations, they often require their vendors to have a “Green Policy.” Having solar panels can help you win larger contracts.

- Customer Loyalty: Displaying a “Powered by Solar” sticker on your storefront builds trust and justifies premium pricing for your products or services.

Common Mistakes to Avoid During Solar Panel Installation for Small Business

To keep your payback period at 3 years, avoid these common mistakes:

- Oversizing the System: If you build a system larger than you need, you are paying for capacity that doesn’t provide a daily return.

- Ignoring Maintenance: While solar is low-maintenance, a thick layer of dust or bird droppings can reduce output by 20%. A simple quarterly cleaning keeps the ROI high.

- Failing to Account for Roof Health: If your roof needs replacing in 5 years, don’t install solar now. Do it simultaneously to save on labor costs.

Conclusion: The Future of Solar Panel Installation for Small Business

Achieving a 3-year payback for a solar panel installation for small business is a result of aggressive tax planning and high-efficiency hardware. By treating solar energy as a financial tool rather than a utility, SMEs can effectively eliminate one of their largest expenses. After the 36-month mark, the system provides nearly “pure profit” for the next two decades, giving your business a massive competitive advantage.

FAQs Regarding Solar Panel Installation for Small Business

1. What is the average lifespan of a commercial solar system?

Most Tier-1 solar panels are warranted for 25 years. However, they can continue to produce electricity at 80% efficiency for up to 35 or 40 years. This makes the long-term ROI incredibly high once the initial 3-year payback is achieved.

2. Can I get a solar panel installation for small business if I lease my building?

Yes! You can opt for a “Power Purchase Agreement” (PPA) or a “Solar Lease.” Alternatively, many landlords are willing to split the cost of installation because it increases the property value and the building’s energy rating.

3. How does weather affect the 3-year payback goal?

Solar panels actually perform better in cold, sunny weather than in extreme heat. While cloudy days reduce production, modern high-efficiency panels can still capture “diffuse light.” The 3-year calculation usually accounts for average regional weather patterns.

4. What is Net Metering and do I need it?

Net Metering allows you to send excess power back to the grid in exchange for credits. For small businesses that are closed on weekends, this is essential to ensure that the energy produced during closing hours still contributes to the 3-year payback.

5. Is there a minimum business size for solar?

No. Whether you are a small “mom-and-pop” shop or a large warehouse, the principles of ROI remain the same. The system is scalable to your specific energy needs and roof size.