Solar is becoming a necessity nowadays. But still why people are holding back from going solar. Initial upfront cost is one big reason. The solar payback period is although 3-4 years but paying such huge cost upfront might not be a feasible idea for a lot of people. Hence, solar financing comes into picture.

What is solar financing?

Solar loans work like any other type of loan—a lender loans you the money upfront, then you make payments for a fixed period until the system is paid off.

It is like government offering subsidies to homeowners and housing societies. The entire concept behind a solar loan is to make things financially simpler for customers.

What are the Conditions to Apply for a Solar Panel Loan?

Credit history is needed to check the credit worthiness of the customer. With the help of solar financing, people can opt to install system without increasing their overall budget.

There’s no better way of going solar than availing a solar panel loan if you do not wish to pay the entire amount at once.

Cost of Solar System vs the Savings From Solar

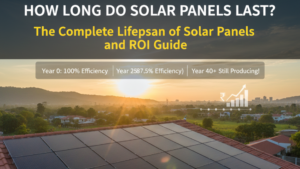

Let’s talk about the cost of installation vs cost of savings of solar.

Take an example for a 4KW solar system. Suppose the cost of per unit of electricity if INR 10/unit and your monthly power consumption is 400 units.

Your monthly bill will be 4000 per month. But after installation of the system, it would be Nil.

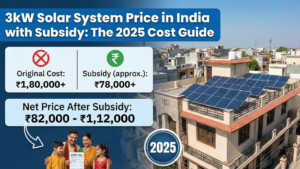

It typically means that savings for the whole year would be INR 40,000 TO INR 48,000. If we consider government subsidies and annual savings of 48,000 per year , this will break even within 3-4 years.

The system that initially costs ₹1,80,000 will give you a yearly saving of approximately ₹48,000. You can imagine the kind of returns you will get throughout the life of the system.

Conclusion

Solar financing is the future. The solar loan will always be an option but solar subsidy will not exist in near future.

FAQs

1. What is solar financing?

Solar financing is the assistance that’s offered to make things easier for customers. There are two options: EMI schemes and solar loans. The EMI schemes are flexible as well.

2. Are there any cons of availing a solar loan?

No cons at all.

3. What are the conditions to get a solar loan?

You need a good credit score, that’s all.