Most people know that switching to solar power reduces monthly electricity costs. However, in 2025, the benefits of solar energy go far beyond just a smaller bill at the end of the month. Solar has evolved into a sophisticated financial asset that offers tax advantages, property appreciation, and inflation protection.

If you are still on the fence, here are the seven hidden financial advantages that make solar one of the smartest investments this year.

1. Passive Cooling Savings: The Cool Roof Effect of Solar Panels

One of the most overlooked benefits of solar energy is the physical impact panels have on your home’s temperature. Solar panels act as a roof shade, absorbing the harsh sun before it hits your roof tiles.

- The Hidden Math: Studies show that solar panels can lower a roof’s temperature by up to 3°C–5°C.

- The Savings: In hot climates (like Rajasthan or similar regions), this reduces the heat load on your home, meaning your air conditioner works 30-40% less to cool the same space. You save money on energy consumption even before the panels generate a single unit of electricity.

2. Financial Protection Against Energy Inflation: Locking in Your Power Rate

Utility companies raise rates annually—often by 4-6%—due to rising fuel costs and grid maintenance. This is often hidden in your bill as “Fuel Surcharge” or “FPPAS” (Fuel and Power Purchase Adjustment Surcharge).

Locking in Your Power Rate: Solar Energy as an Investment Against Price Hikes

When you install solar, you are effectively pre-paying for 25 years of electricity at a fixed price (the cost of the system). While your neighbors’ rates double over the next decade, your cost per unit remains effectively zero after your break-even point.

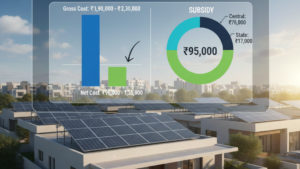

3. High-Value Government Incentives & Subsidies (2025)

Governments are aggressively pushing for renewable adoption. In 2025, the financial aid available is substantial.

- In India (PM Surya Ghar Muft Bijli Yojana): Homeowners can receive a subsidy of up to ₹78,000 for systems above 3kW. This directly slashes your upfront investment (ROI) time by 1-2 years.

- Global Context (US ITC): In regions like the US, the Investment Tax Credit (ITC) allows you to deduct 30% of the system cost from your federal taxes.

4. Boost Property Value Instantly: A Key Financial Benefit of Solar Energy

Does a home with zero electricity bills sell faster? Absolutely. Real estate data in 2025 confirms that homes with pre-installed solar systems sell for a premium.

- The 4% Rule

On average, solar-equipped homes see a property value increase of roughly 3-4%. For a ₹50 Lakh home, that is an instant ₹2 Lakh value addition—often covering half the cost of the solar system itself. This is one of the tangible benefits of solar energy that you realize when you sell your property.

5. Net Metering: Turning Your Meter Backwards

Net metering is the financial engine of a solar system. It allows you to “store” your excess energy on the grid.

- How it earns you money: During peak sun hours (11 AM – 3 PM), your system generates more power than you use. This excess is exported to the grid. At night, you pull this power back for free.

- The Bonus: In some states, if you generate more than you consume annually, the electricity board actually pays you for the surplus units at a determined rate.

6. The EV Ecosystem: Free Fuel for Life with Solar Power

If you plan to buy an Electric Vehicle (EV) in the next 5 years, your solar system acts as your personal petrol pump.

- Solar vs. Petrol Math

Charging an EV from the grid costs roughly ₹1 per km. Charging it from your own solar panels costs effectively ₹0. You are decoupling your transportation costs from global oil prices. This integration is one of the most futuristic benefits of solar energy.

7. Low Maintenance & High Longevity

Unlike a car or an AC unit, solar panels have no moving parts. This means they rarely break.

- The Reality: Most Tier-1 solar panels come with a 25-year performance warranty.

- The Cost: Maintenance is typically limited to cleaning (washing dust off) every 2-3 weeks. The running cost is negligible compared to the thousands saved, ensuring your Return on Investment (ROI) remains high.

Comparative Analysis: Choosing the Best Solar Financing Models for Your Financial Goals

Choosing how to pay for solar affects your long-term savings. Here is a breakdown to help you decide.

| Financing Model | Upfront Cost | Who Gets the Subsidy/Tax Credit? | Monthly Savings | Best For… |

| Cash Purchase | High (100%) | You (The Owner) | Maximum (100% of bill) | Maximize long-term savings & ROI. |

| Solar Loan | Low (Down payment) | You (The Owner) | High (Bill savings > Loan EMI) | Owners who want ownership but limited cash flow. |

| Solar Leasing | Zero | The Solar Company | Medium (Fixed monthly fee) | Those who want no maintenance hassles. |

| PPA (Power Purchase) | Zero | The Solar Company | Low (Pay per unit generated) | Commercial buildings or those ineligible for loans. |

25-Year Savings Projection (Grid vs. Solar): Visualizing Your Financial Benefits

Assumption: A standard 5kW Home System with a monthly bill of ₹5,000 (60).

| Year Timeline | Cost of Staying on Grid (Assuming 5% Inflation) | Cost of Solar (One-time Investment) | Cumulative Savings |

| Year 1 | ₹60,000 | ₹2,50,000 (approx. with subsidy) | -₹1,90,000 (Investment Phase) |

| Year 5 | ₹73,000 | ₹0 | Break-Even Point (Investment Recovered) |

| Year 10 | ₹93,000 | ₹0 | ₹4,50,000 Saved |

| Year 20 | ₹1,50,000 | ₹0 | ₹12,00,000 Saved |

| Year 25 | ₹1,90,000 | ₹0 | ₹20,00,000+ Saved |

Note: The benefits of solar energy compound over time. As grid electricity gets more expensive, your savings actually accelerate.

Conclusion: Unlocking the Comprehensive Financial Benefits of Solar Energy

The decision to go solar in 2025 is no longer just an environmental one; it is a calculated financial strategy. By leveraging subsidies like the PM Surya Ghar Yojana, protecting yourself from inflation, and increasing your property value, you create a passive income stream that lasts for decades.

The benefits of solar energy extend far beyond the obvious. You aren’t just saving on bills; you are investing in an asset that pays you back every single day the sun shines.

Frequently Asked Questions (FAQ) on the Financial Benefits of Solar Energy

Q1: Do solar panels work on cloudy days or during the monsoon?

A: Yes, but with reduced efficiency. Panels use daylight, not just direct heat, to generate power. On a very cloudy day, generation might drop to 25-40%, but they still produce energy.

Q2: What is the “Payback Period” for a residential solar system?

A: In 2025, with current subsidies and panel efficiency, the average payback period is 3 to 5 years. After this period, the electricity generated is virtually free for the next 20 years.

Q3: Can I run my AC on solar power?

A: Absolutely. In fact, solar is perfect for ACs because you typically need cooling when the sun is hottest—exactly when your panels are producing the most power. You just need to ensure your system size (kW) matches your load.

Q4: What happens if I sell my house?

A: The solar system is transferred to the new owner. Because of the benefits of solar energy (free electricity), buyers are often willing to pay a higher price for your home.